Arthro-Ionx Healthy Joint Support for Pets – Buy 5 Get 4 Free

Arthro-Ionx Healthy Joint Support for Pets – Buy 5 Get 4 FreeAll-natural Arthro-IonX is a product that . . . Effectively relieve your pet’s joint and muscle pain. Help your pet regain his mobility. Revitalize your pet’s energy in days. Support your pet’s flexibility. Work naturally and safely to help your pet’s body begin the healing process – Buy 5 Get 4 Free!

Architect Magazine subscription – A print format magazine dedicated exclusively to the world of PHP. Each issue contains articles that cover topics from the basics to such advanced topics as PHP internals and Internet protocols all in an easy-to-read conversational and yet professionally accurate tone. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within…

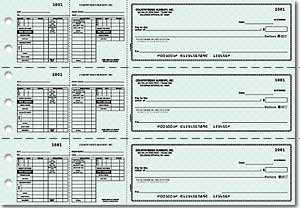

Natures Majesty Laser Checkontop

Natures Majesty Laser CheckontopCompatible with Microsoft Money, Quickbooks, Simply Media/Simply Money, MECA – DOS vs. 10-12, and MECA – Windows.

Marie Claire Magazine subscription – Marie Claire offers solutions for the woman whose time constraints demand one resource to respond to diverse aspects of her life. From global and cultural issues to fashion and beauty coverage Marie Claire is for the woman of substance with an eye for style. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within three…

Ellery Queens Mystery Magazine subscription – Top-notch stories written by the world s leasing crime and mystery writers including Lawrence Block Jeffery Deaver Margaret Maron Val McDermid Anne Perry Ruth Rendell and Peter Robinson. Issues include short stories book reviews mystery crosswords and more. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within…

Beckett Plushie Pals Magazine subscription – A kid-friendly guide to todays popular plush toys and their online virtual worlds. Youll find coverage of Webkinz Neopets Beanie Babies Shining Stars and many other favorites. Each issue is packed with tips to care for your virtual plush pets online game strategies and price guide checklists. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine…

Health Information Compliance Alert Magazine subscription – This hands-on guide to complying with tough HIPAA mandates on information privacy and security is guaranteed to answer your important HIPAA compliance concerns. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within three to eight weeks and monthly magazine subscriptions will commence within four…

Sea Classics Magazine subscription – Combines trends in the naval and maritime world with stories of men and ships in the sea. Focuses on naval history tracing the epic sea battles of all eras. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within three to eight weeks and monthly magazine subscriptions will commence within four to twelve weeks.

Inside Triathlon Magazine subscription – Provides information for triathlon and duathlon insiders around the world. Features training tips and techniques form the pros extensive race coverage interviews with top athletes and a calendar of events. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within three to eight weeks and monthly magazine subscriptions…

Suede 3on Personal Laser

Suede 3on Personal LaserCompatible with Microsoft Money, Quickbooks, Simply Media/Simply Money, MECA – DOS vs. 10-12, MECA – DOS V.10-12, and MECA – Windows.

Foxfire Magazine subscription – Aims to foster an active learner-centered approach to education for teachers and students around the country by encouraging connections to local communities. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within three to eight weeks and monthly magazine subscriptions will commence within four to twelve weeks.

Executive Gray Payroll Salaried/Hourly Checks 3 on a page

Executive Gray Payroll Salaried/Hourly Checks 3 on a pagePayroll-Salaried/Hourly Checks provide a breakdown of earnings and deductions for your employees and your records with pre-printed captions; checks include 7 lines for extra captions. These checks are designed to fit a 7-ring binder only.

Barnyard Buddies

Barnyard Buddies These beautifully illustrated checks feature children, animal friends, tractors, and life on the farm. Coordinating return address labels and checkbook cover are available

American Snowmobiler Magazine subscription – THE LEADING SNOWMOBILE MAGAZINE INCLUDES EVERYTHING YOU NEED TO HAVE AN AWESOME SNOW SEASON. EVERY ISSUE INCLUDES HONEST REVIEWS OF NEW SLEDS AND ACCESSORIES PERFORMANCE TIPS HOW-TO ARTICLES TRAVEL DESTINATIONS AND MUCH MORE! PLUS THE ANNUAL BUYERS GUIDE & INDUSTRY DIRECTORY IS INCLUDED Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine…

Scrap & Stamp Arts Magazine subscription – Provides extensive information about scrap electronics management and recycling. This periodical reports on product stewardship initiatives collection programs recycling markets recovery technologies legislation and regulation and industry news. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within three to eight…

Tinker Bell Cover w/Converter

Tinker Bell Cover w/ConverterImpressed leaves and flowers surround Tinker Bell on this vibrant green leather cover. Includes a converter to fit your side tear checks.

Package of one year subscriptions for National Geographic Adventure and Outside.

New York Times Upfront Magazine subscription – A magazine created for and by girls ages 7-12! Discovery Girls is a forum for girls to both express their ideas/dreams and address their fears. With articles on middle school challenges inspiring stories about exceptional teens sports contests quizzes embarrassing moments fashion and more! Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine…

American Forests Magazine subscription – Dedicated to people who care about trees and forests. Explores recreation conservation wildlife urban forests wilderness genetics air pollution effects tropical deforestation changing recreational attitudes unfolding legislation and the future of national forests. Important delivery note – Please allow an industry Subscription average of three to twelve weeks for delivery of the first issue of your subscription. Weekly magazine subscriptions will begin within…